IAA 2022 proves electric truck is the future

Diesel truck has seen its best days

Several truck manufacturers predict that by 2025, 10% of their sales will be Zero Emission. By 2030, this number may rise to 50% and another five years later, diesel versions may not even be bought in the Netherlands. We therefore see that all brands are now rapidly introducing electric models. High time to take stock.

Anyone who walked through the IAA Transportation in Hanover last month undoubtedly imagined themselves in 2030. At the world's largest trade fair for the transport industry, you almost had to use a magnifying glass to look for diesel engines. Trucks with such a self-igniter were parked somewhere in a corner of the booth, or many brands had banned them from the show altogether! Everywhere, stickers with cries like Zero Emission, Electric and Fuel Cell screamed for attention, as if by now at least half of all vehicles are equipped with a zero-emission powertrain. Not exactly, but clearly the big truck brands care deeply about accelerating that transition.

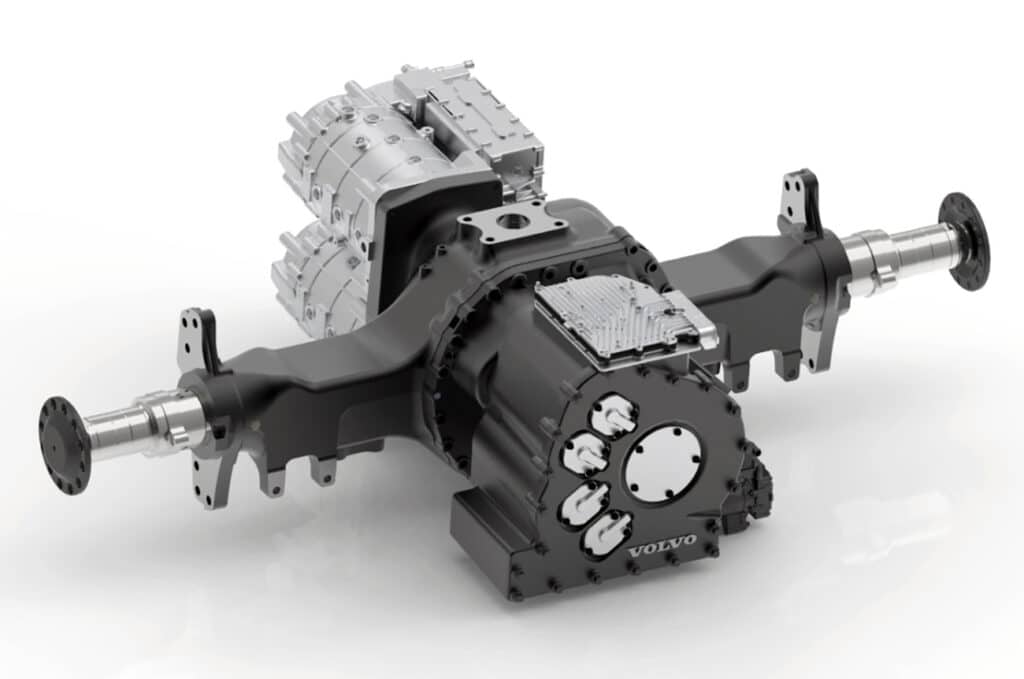

So, apart from the introduction of the DAF XFc and XDc construction vehicles, the highlights of the show were the introduction of battery-electric trucks, study models of fuel cell applications and further refinement in the form of updated e-axles. Range figures fly up from 200 to 350 to 400 kilometers on a battery charge, and with the latest generation - with the electric motor plus transmission integrated into the drive axle - it's soon heading toward 600 to even 800 kilometers for a 4×2 tractor. After all, this creates more space for the battery pack. So great strides are being made, but when is it wise to switch to e-mobility?

Faster than expected

Johnny Nijenhuis closely follows developments in the market and flawlessly links them to studies in the field of energy transition. As an expert on Zero Emission trucks, he advises companies on their way to a sustainable future and invariably quotes a formula from Daimler Truck chief Martin Daum during workshops, namely: available vehicles x available infrastructure x cost benefit. "If one of those parameters is zero or negative, then we won't get much further in terms of sustainability. If I look at the availability aspect, then it can be concluded that developments are currently moving faster than many would have expected two years ago."

That applies both to the availability of different brands and the development of battery technology. Nijenhuis: "The disadvantage of electric vehicles that they are very expensive and heavy is slowly changing. Compared to more than ten years ago, batteries have already become half as light and we are expected to save another 50% in weight by 2030. In terms of price, I see a similar development. Compared to 2010, batteries are now four times cheaper than they were then and within ten years they could drop by another factor of 3. The technology is still young and you can see that there is a development battle going on in this area between various truck brands, which copy a lot from each other. It is a kind of 'leapfrogging'."

Get your bearings now

When it comes to loading and infrastructure, Nijenhuis distinguishes between public charging and on-site charging, also known as depot charging. That first category will account for 10-20% of all loading cycles and requires special loading capacity for trucks. Several parties are jumping into that commercial logistics loading market. "An overwhelming majority will soon opt for depot loading, because trucks are stationary for part of the day anyway under the Driving Hours Act. Loading on private property, especially for carriers with several dozen - if not hundreds - of trucks, requires a lot of energy. I advise companies to think about grid reinforcement right now, even if you don't switch to electric driving right away."

The waiting time for this soon runs to three to four years, Nijenhuis knows. "Those who realize the potential of Zero Emission too late will soon not even be able to compete on price, even if you wanted to." Late last year, the expert already managed to make calculations in which the TCO of electric trucks turned out to be more favorable than for a diesel variant. "Due to a huge increase in the price of energy, that flyer no longer holds true, but I am convinced that the diesel price will rise sharply in the future once we stop importing oil from Russia. Then there will be a huge scarcity. I am a firm believer in electrification and am happy to help companies on their way. For a cost calculation, take a look at www.elektrischevrachtwagen.nl."

Growth of 50 á 60%

On the issue of costing, Nijenhuis can be brief. Margins are already wafer thin, so for many companies price will be the deciding factor. "You therefore see mainly large players in the market catching on to emission-free driving in order to make a statement. Moreover, they would rather pay a learning price for one e-truck now than wait until the time comes and then fall into all kinds of pitfalls. Some 300 BEV trucks are now driving around in the Netherlands, up from 200 a year ago. In 2023, another 150 to 180 electric trucks are expected, so you're talking about a growth of 50 to 60%. Then, of course, at some point it goes very fast. I don't rule out that that market continues to grow exponentially fast."

Based on lower maintenance costs - 30 to 65%, according to Bovag - and the prospect of electric trucks getting a discount on the mileage charge that is likely to go into effect in 2026 or '27, the tipping point falls quickly in Zero Emission's favor. Nevertheless, the price of energy remains a major factor in the acceleration. For trucks with fuel cell technology, Nijenhuis paints a less rosy picture. "The price makes it difficult to compete with electric or diesel-powered vehicles. At the IAA, several brands showed an H2 study model and in our country the first trucks are already driving around on hydrogen, but I see advantages in this only for very specific applications and therefore not in terms of large numbers."